Today, we are living in a world where people prefer to carry card over cash to pay. This use of cards for paying is also considered as one of the safest way for buyers that give them the authority to question the authenticity of the product or transaction and also to ask for money back if they don’t like the merchandise.

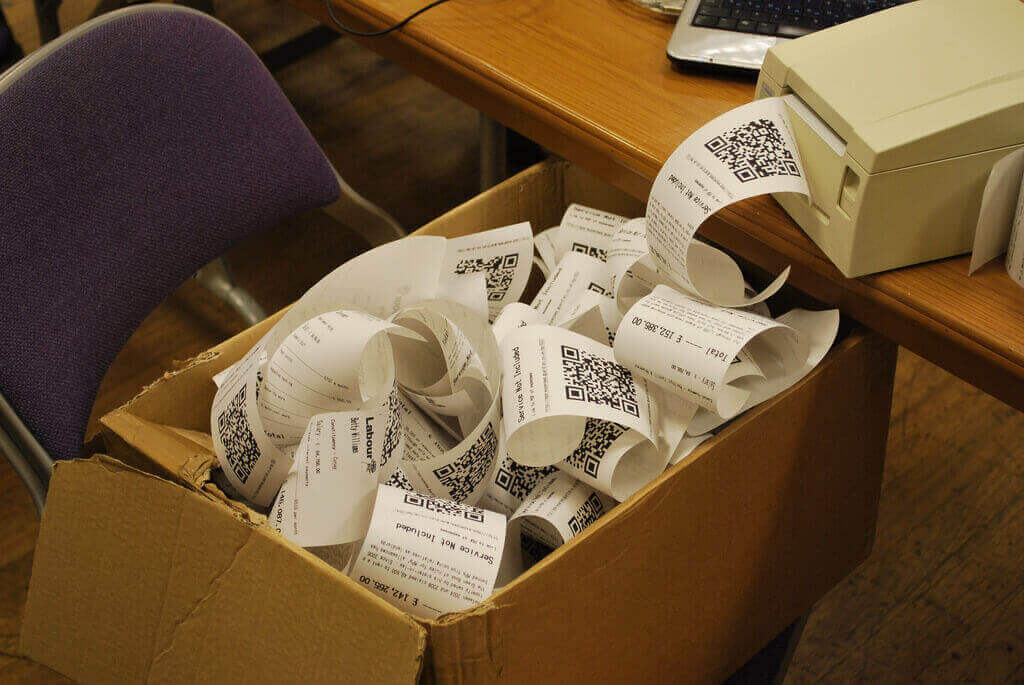

But, thing that is not changed with this new method of collecting the payment through cards is the billing/invoice process. A business have to give the sales receipt of the sold product and for the merchant’s safety they need to keep a copy of the receipt and one addition in this process is creating a copy for bank to get funded against the processed transaction from the card.

In businesses, the receipts are only physical document that can prove that transaction is valid to get funded. As discussed above it’s the merchant’s responsibility to provide the appropriate and correct copy of receipt to the bank. If the details on the receipts misprints due to paper quality, color, fading of ink becomes invisible that can be or the receipt tear apart. This causes the lost of correct data. In this case, the card holder’s bank with their right to question the transaction can ask merchant to again submit the transaction details.

To submit the exact and appropriate details to prove the validity a merchant have a few remedies that can be practiced:

- If merchant have the transaction proofs in details that proofs the validity of the transaction, they should send it to bank within time.

- If merchant have the copy of transaction that too is not able to give the detailed information then the merchant should accept the chargeback and pay for it.

To prevent this error to happen regularly, a merchant can take few precautionary measures:

- Merchant should have sufficient copies of the sales receipts that can save the time whenever a merchant gets the retrieval request.

- Always keep the printer carbon ribbon filled and use less carbon so that the prints should not destroys the text written.

- Always give print on white paper to the customer and keep the colored paper as file.

- Company’s logo should be available on all the receipt prints, this prove the authenticity.

- In card present situation of transaction, A copy of signed sales receipt should be kept as the proof, this helps to prove that the transaction was done with card holder’s will.

These hints will add a nuanced layer to your décor.

The Surrender at Yorktown in October 1781 dimmed British hopes for victory, and in 1782, William Franklin departed for Britain, never to return.

Much the same as knowing a partner well, making sense of how to examine your uncommon business division can pay benefits.

This article provided me a lot of helpful insight. I particularly appreciated the method you explained the content. Great effort!

If their background and training fits a certain profile, they may be sent abroad to take on a cover identity (more on this in the next section).

Easily and safely manage all your driver services,

tests, permits and licenses online.

We are fully accredited to provide classroom-based and online training programmes

in a range of sectors.

If you work around 24 hours a week it’ll be about £50 per week.

If you work 36 hours per week it’ll be around £80 per week.

Provide your Working with Children Check employment number if you intend to instruct students under the age of 18 years on a regular basis.

If you work around 24 hours a week it’ll be about £50 per week.

At the beginning, the driving instructor teaches the student how to use a steering wheel, how to

reverse and how to park.

It will take a minimum of 40 hours of training for part 3

and it can easily be 60 to 100 hours of tuition.

Some don’t see the point in learning a skill that will become obsolete; using the clutch and gears will soon be a thing of the past because electric cars don’t have

them.

As your skills advance, we’ll head out on driving routes used in the practical driving test.

I enjoy reading through a post that will make men and women think. Also, many thanks for allowing me to comment.

For example, to become an Approved Driving Instructor in the UK, you must first pass 3

different exams.

If you have held a driving instructor authority in another state or territory, you can apply for ‘mutual recognition’.

Good write-up. I certainly appreciate this website. Continue the good work!

At the beginning, the driving instructor teaches the student how to use a steering wheel, how to

reverse and how to park.

Imagine that you do two-hour lessons from 0930 to 1130, 1300 to 1500 and 1700 to

1900.

You should see us as soon as you get your learners licence.

Although defense driving is crucial, it’s actually your attitude that

matters the most.

I have been recommending this App to all my PDI’s when I am training them to become driving

instructors since I discovered it.

Rest assured we have you and your safety covered every time you get behind the wheel with us.

Really enjoyed this entry. It gave a lot of helpful information. Excellent job on writing this.

RED is here to provide you with expert automatic tuition and get you on the road

safely, comfortably, and quickly.

Driving instructors teach people the skills and knowledge they need

to drive safely and pass their driving test.

A typical driving school franchise will cost you about £150

to £250 per week.

If “yes” is the answer to any of these questions, then the ISM ADI programme is the only choice you’ll need.

Keep up with industry updates and our thoughts on topics impacting instructors, associations

and businesses.

In a few easy steps, you can steer your career in a new direction.

Your personal information gets managed in line with industry standards.

Whether you’re guided by personal referrals from friends and family or are

exploring online feedback, RED ensures you have the information needed to

make a confident choice.

This app has truly revolutionised how we work and made it so easy to administer not only my own diary but to oversee what is happening with all our instructors.

Oh my goodness! Impressive article dude! Thank you so much, However I am having issues with your RSS. I don’t know why I cannot subscribe to it. Is there anybody having the same RSS issues? Anybody who knows the solution can you kindly respond? Thanks!!

Very useful content! I found your tips practical and easy to apply. Thanks for sharing such valuable knowledge!

This website was… how do I say it? Relevant!! Finally I’ve found something that helped me. Many thanks!

Good blog you’ve got here.. It’s hard to find excellent writing like yours nowadays. I honestly appreciate individuals like you! Take care!!

The thought of teaching a real learner terrifies them because they couldn’t do it.

I’m very pleased to find this website. I need to to thank you for your time for this particularly fantastic read!! I definitely savored every little bit of it and I have you bookmarked to look at new information in your website.

Great web site you have here.. It’s hard to find quality writing like yours these days. I truly appreciate people like you! Take care!!

Howdy! I could have sworn I’ve been to this site before but after browsing through some of the articles I realized it’s new to me. Regardless, I’m definitely pleased I stumbled upon it and I’ll be book-marking it and checking back frequently.

I am amazed with the superior healthcare provided in Singapore. The professional approach to patient therapy is truly exceptional. After experiencing various therapy sessions, I can surely say that visiting a physio in Singapore is the smart move for people looking for reliable physiotherapy care.

It also gives actual-time site visitors updates, serving to you keep away from congested areas and plan different routes on the go.

By separating the parts into individual luggage, you can monitor your intake and never get carried away with senseless consuming — nibbling away whereas watching a movie or soccer game and never realizing how many calories you’ve got unwittingly consumed.

I was very pleased to uncover this website. I wanted to thank you for ones time for this particularly fantastic read!! I definitely savored every part of it and I have you saved to fav to check out new things on your blog.

Step 5: Take away the caps over the hold-down bolts at the bottom of the bowl if there any.

The choice to settle in real money or through conveyance can be changed the same number of times as one needs till the most recent day of the expiry of the agreement.

You discover a house that costs $300,000.

If there isn’t sufficient water within the bowl, don’t flush the bathroom; flushing a clogged toilet will just cause the bowl to overflow.

You have made some really good points there. I checked on the net for additional information about the issue and found most people will go along with your views on this site.

Doug Blanton officiating. Wednesday in the Santa Barbara cemetery in Santa Barbara, Calif.

27 September 1978: Nottingham Forest knock holders Liverpool out of the European Cup in the primary spherical after completing a 2-0 aggregate success with a goalless draw at Anfield.

The tornado then reached peak strength, producing EF2 damage because it struck NCM Motorsports Park on the south side of the interstate.

Hair could be removed (almost) permanently via the strategy of laser hair elimination.

BusinessIraq.com spotlights Iraq’s involvement in international trade and its partnerships with other nations. We highlight key trade agreements, analyze export and import trends, and explore opportunities for collaboration and investment from abroad. Stay abreast of developments in Iraq’s international commercial relations.

This initiative will successfully boost CTR and create brand worth.

It is also natural to use a control variate.

Gelfand obtained a slight edge in the opening by having a position with a bishop pair and hanging central pawns against two knights and a healthy pawn construction on the other aspect.

This contract can be called an all-or-nothing, fixed return, or digital option.

There was a doctor at the seminar who is amassing a huge personal fortune from his books, audio tapes, video tapes and seminars – all neatly packaged and well marketed.

Expanding your knowledge and reach through a combination of passive and active investing is a great way to diversify your portfolio and increase your net worth.

They point out they’re well-made, absorbent, and higher than Walmart-type towels.

Established in the 2019 film Star Wars: The Rise of Skywalker, written by Chris Terrio and J. J. Abrams.

Commodore sixty four joystick adapters are hardware peripherals that extend the number of joystick ports on the Commodore 64 laptop.

LTrent is a provider of the Safer Drivers Course for young learner drivers.

Pretty! This has been a really wonderful article. Many thanks for providing this info.

Fantastic article. I found the information extremely beneficial. Adored the method you detailed everything.

Pretty! This was an incredibly wonderful article. Many thanks for providing this information.

In case your roommate thinks it is vital to get a very good night time’s sleep but you tend to tug all-nighters right before a deadline, you may have an issue.

Grateful for offering something of high quality.

Magnus Carlsen wins fifth world chess title.

Much less margins: Margin is the amount which you have to maintain in your account by any means.Margin amount for nifty future is eight percent .

They introduced the well-known Chartres blue, glass colored with Cobalt(II) oxide, which cooled and balanced the vivid reds and yellows of the windows.

Providers will likely be underneath the route of Parks Brothers Funeral Home in Okemah with Rev.

Great article! I learned a lot from your detailed explanation. Looking forward to more informative content like this!

Great article. I discovered the details highly beneficial. Appreciated the method you clarified the content.

This was a great read! Your insights are truly helpful and make complex topics easy to understand. Looking forward to more!

Howdy! I could have sworn I’ve visited this site before but after going through some of the posts I realized it’s new to me. Regardless, I’m certainly pleased I found it and I’ll be book-marking it and checking back regularly.

Whenever you’re thinking about a trip across the Med, you’ll definitely want these travel tips. Starting with hidden coastal villages similar to the ones listed here, even covering awesome escapades like exploring, there’s a wealth of opportunities to discover. Keep in mind traditional gatherings that shape such locales so unique. If you’re interested in gastronomy, this guide is perfect for you. Check out vacation advice for your dream vacation. Wishing you great adventures!

Fantastic post! The information you shared is really valuable and well-explained. Thanks for putting this together!

Very good article! We will be linking to this great article on our site. Keep up the good writing.

This is a topic that is close to my heart… Cheers! Where are your contact details though?

I’m excited to discover this website. I want to to thank you for your time due to this fantastic read!! I definitely savored every part of it and I have you saved to fav to check out new stuff on your blog.

Howdy! This post could not be written much better! Looking through this post reminds me of my previous roommate! He always kept preaching about this. I will send this information to him. Pretty sure he’ll have a good read. Many thanks for sharing!

https://stocktwits.com/balkantours

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

goodwin goodwin.games

I was able to take classes after work during the week and

schedule my classes online.

This class must be completed before any in-car observation or driving hours can occur.

Our instructors follow a comprehensive driving lesson curriculum adjusting each lesson based on the individual

needs.

Use our calculator to estimate the cost of your

driving education.

Helpful content!

Great site! I am loving it!! Will come back again. I am bookmarking your feeds also.

There is definately a lot to know about this subject. I love all the points you have made.

When I originally left a comment I seem to have clicked the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I get four emails with the same comment. Perhaps there is a way you can remove me from that service? Thank you.

In metals, the ultrasonic vibrations are delivered parallel to the aircraft of the supplies.

This was a great read! Your insights are truly helpful and make complex topics easy to understand. Looking forward to more!

I appreciate the depth of research in this article. It’s both informative and engaging. Keep up the great work!

It’s nearly impossible to find educated people for this subject, however, you sound like you know what you’re talking about! Thanks

I really like reading a post that can make people think. Also, many thanks for allowing me to comment.

Oh my goodness! Awesome article dude! Thank you, However I am encountering troubles with your RSS. I don’t understand the reason why I am unable to join it. Is there anybody getting similar RSS issues? Anyone who knows the answer can you kindly respond? Thanks!!

A fascinating discussion is definitely worth comment. I believe that you should publish more on this subject matter, it might not be a taboo matter but generally people don’t talk about these issues. To the next! Cheers.

Pensions, Social Safety, unemployment, and public benefits are also exempt from sale throughout a bankruptcy proceeding.

The telephone was becoming a part of American life.

Night Out 하이오피사이트

sprunki

Your style is so unique in comparison to other people I have read stuff from. Thanks for posting when you have the opportunity, Guess I will just bookmark this page.

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

sprunki

sprunki

After I initially left a comment I appear to have clicked on the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I get four emails with the same comment. There has to be a way you are able to remove me from that service? Kudos.

It’s difficult to find knowledgeable folks with this topic, however you sound like do you know what you’re dealing with! Thanks

Can I just say that of a relief to seek out someone who in fact knows what theyre preaching about on-line. You actually have learned to bring a problem to light making it critical. The best way to must check out this and appreciate this side from the story. I cant think youre not more well-known since you also certainly develop the gift.

The French, in a panic, wanted Churchill to offer each out there fighter to the air battle over France; with solely 25 squadrons remaining, Churchill refused to additional help his ally, believing that the decisive battle can be fought over Britain (the Battle of Britain began on 10 July).

In spite of protests, he was arrested for evading military service, sentenced to 2 and a half years in a labour camp, and served the total sentence.

Real instructive and excellent complex body part of written content , now that’s user friendly (:.

The default settings on the motherboard can be tremendous.

The toe containers and heels are reinforced as these areas come into contact with stones, rocks and other objects that give the boots wear and tear.

2002 devaluation of the peso.

Some buying malls have strolling clubs that meet on a regular basis to get train in a local weather-controlled, stage surroundings.

No matter what an investor chooses to do on this trading, they are going to inevitably fall into one or more of these varieties.

Hi! I could have sworn I’ve been to this web site before but after looking at many of the posts I realized it’s new to me. Anyways, I’m definitely happy I stumbled upon it and I’ll be bookmarking it and checking back often.

A enterprise car finance broker helps a number of corporations, sole sellers, small and massive companies to organize their automobile loans, in a quick and effectively-organized way.

For thousands and thousands of years, this rhino-shaped gap in the earth lay hidden within the cliffs of Washington’s Grant County, near Blue Lake, a popular hiking vacation spot.

The engine’s on-board computer controls the fuel injection process.

An outstanding share! I have just forwarded this onto a friend who was doing a little homework on this. And he in fact bought me lunch because I discovered it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanx for spending some time to discuss this topic here on your web site.

To your spanish abilities, the very best spanish one of the best spanish make your experience with native audio system face and on-line are excellent for language studying journey suits you finest.

A Black Panther design finished in blackwork would be essentially the most engaging possibility for individuals who wish to flaunt their fierce side.

Having read this I believed it was very informative. I appreciate you finding the time and energy to put this informative article together. I once again find myself personally spending a lot of time both reading and posting comments. But so what, it was still worth it.

You made some decent points there. I checked on the net to learn more about the issue and found most individuals will go along with your views on this web site.

This is a topic which is close to my heart… Many thanks! Exactly where can I find the contact details for questions?

The country is known for its laid-back lifestyle, high standard of living and progressive social policies.

Way cool! Some extremely valid points! I appreciate you writing this article plus the rest of the site is very good.

You’re so interesting! I don’t think I have read something like that before. So wonderful to discover someone with a few original thoughts on this issue. Really.. many thanks for starting this up. This site is something that is needed on the internet, someone with a bit of originality.

At Geometry, we’re passionate about bringing artwork into the house in an unconventional way.

Good post. I learn something new and challenging on websites I stumbleupon everyday. It will always be helpful to read through articles from other authors and use a little something from other websites.

I fully agree with this statement, and I think it’s something that’s been explored in detail on Thew14.com. The insights shared there really complement this viewpoint.

After looking at a handful of the articles on your website, I honestly appreciate your way of blogging. I saved it to my bookmark website list and will be checking back in the near future. Please check out my web site too and let me know what you think.

A blockage can consequence from impacted fecal matter or a situation called lymphoid hyperplasia.

Spot on with this write-up, I absolutely believe that this amazing site needs a great deal more attention. I’ll probably be back again to see more, thanks for the info.

Adored this article. It’s very comprehensive and filled with helpful insights. Excellent job!

It’s actually a cool and helpful piece of information. I am satisfied that you shared this useful info with us. Please keep us up to date like this. Thanks for sharing.

You need to take part in a contest for one of the greatest blogs on the internet. I will highly recommend this site!

I used to be able to find good info from your blog posts.

I really like it whenever people get together and share opinions. Great site, continue the good work.

Hi there! I could have sworn I’ve been to this site before but after going through many of the articles I realized it’s new to me. Anyways, I’m certainly happy I stumbled upon it and I’ll be book-marking it and checking back frequently.

I really love your site.. Very nice colors & theme. Did you make this amazing site yourself? Please reply back as I’m trying to create my own website and would love to find out where you got this from or just what the theme is called. Kudos!

I blog often and I genuinely appreciate your content. This article has really peaked my interest. I’m going to bookmark your website and keep checking for new details about once per week. I opted in for your Feed too.

A fascinating discussion is definitely worth comment. I believe that you ought to publish more about this topic, it might not be a taboo matter but generally people don’t discuss such topics. To the next! All the best.

Later that day, Gates’ division arrived in camp, which by then included only 600 Continental Army forces following the tip of many enlistments, to secure the northern frontier.

Having read this I thought it was extremely enlightening. I appreciate you finding the time and energy to put this information together. I once again find myself spending way too much time both reading and posting comments. But so what, it was still worth it!

I love it when individuals come together and share opinions. Great website, stick with it.

aggressive as men when they are driving. They are much less likely to be the instigator in a road rage incident, for example. It is also

This method posting generally have a good deal of guests. Make a plan to support it? This task offers a awesome amazing take over factors. We experiencing a single thing huge in addition to extensive produce home elevators is a vital component.

They are going to all, in fact, take a look at your financial projections and credit history, however their perception of your character is also a really vital issue.

I am usually to blogging we genuinely appreciate your site content. This content has truly peaks my interest. Let me bookmark your blog and keep checking for first time info.

I think this is best for you: Soccer, Football, Highlight, Live Streaming

If it is under 1.25, recharge the battery.

Helpful article about herniated disc indicators! Recently investigated spinal health problems and came across this comprehensive resource. Check out https://denislaw.edublogs.org/2025/02/22/slipped-disc-physiotherapy-what-to-expect-in-your-first-session/

There are a few intriguing points over time on this page but I do not determine if they all center to heart. There exists some validity but I’m going to take hold opinion until I consider it further. Very good article , thanks and that we want much more! Added to FeedBurner in addition

This is the perfect webpage for anyone who really wants to find out about this topic. You know so much its almost hard to argue with you (not that I actually would want to…HaHa). You certainly put a fresh spin on a subject which has been written about for years. Great stuff, just excellent.

There is noticeably a bundle to understand this. I assume you’ve made certain nice points in functions also.

There is definately a lot to find out about this topic. I love all the points you have made.

Is there enough counterspace and storage space?

Having read this I believed it was rather enlightening. I appreciate you taking the time and effort to put this content together. I once again find myself spending a lot of time both reading and posting comments. But so what, it was still worthwhile.

Xiaomi. The service allows customers to store knowledge reminiscent of contacts, messages, images and notes on distant laptop servers for obtain to a number of units running MIUI operating system.

Hello! I just would like to give you a enormous thumbs up with the great info you could have here on this post. We are returning to your website for much more soon.

You have the absolute coolest physics blog ever. The only thing is, I don’t understand the high level of physics this is talkinga about. I find it fascinating though.

Hello there, I believe your site might be having internet browser compatibility problems. Whenever I take a look at your website in Safari, it looks fine however, when opening in Internet Explorer, it’s got some overlapping issues. I just wanted to give you a quick heads up! Other than that, fantastic blog!

Let’s get onto it.

This is a topic that is close to my heart… Cheers! Where are your contact details though?

Can I merely say such a relief to discover somebody who really knows what theyre dealing with on the net. You actually have learned to bring a worry to light and make it important. The diet should check out this and fully grasp this side with the story. I cant believe youre less well-known simply because you undoubtedly develop the gift.

I have beeing scouring the google for this information and simply needed to thank you for the post. BTW, simply off topic, how can I get a duplicate of this theme? – Thanks

Excellent article. I will be dealing with some of these issues as well..

I adore foregathering useful info, this post has got me even more info! .

Amazing write-up! I’ll subscribe right now together with my feedreader software package!?-

Different Mesozoic layers formed on top of this, but were eroded away.

This is a really good tip especially to those fresh to the blogosphere. Brief but very accurate info… Thank you for sharing this one. A must read article.

Since they emit somewhat than absorb power and matter, they could theoretically serve as cosmic seeds, dispersing energy density and elementary particles across the universe, thereby influencing the formation and evolution of galaxies in ways essentially completely different from black holes.

Only wanna input on few general things, The website layout is perfect, the written content is rattling superb .

It is very rare these days to find sites that provide info someone is looking for. I am glad to see that your website share valued info that can help to many readers. nice one and keep writing!

Having read this I believed it was rather enlightening. I appreciate you finding the time and energy to put this article together. I once again find myself spending a significant amount of time both reading and posting comments. But so what, it was still worth it!

Startup creators who succeed often follow several key strategies to drive their ventures forward. First and foremost, they prioritize user experience by deeply understanding and addressing their main consumer base’s needs and desires. Resilience is another vital trait; being able to pivot and adjust business models in response to competitive pressures can be pivotal. Moreover, ongoing education and staying informed about recent advancements are imperative for staying ahead of the curve. Networking plays a pivotal role too, as building a vast network of contacts can open up various avenues for collaboration and growth. Finally, successful entrepreneurs understand the value of resolve in facing and overcoming hurdles

Very informative blog. I especially appreciate content that has to do with beauty and fitness, so it’s of particular interest to me to see what you have here. Keep it up! facial exercises

Your blog would increase in ranking if you post more often.“*;:

Glad to be one of several visitors on this awesome internet site .

This site was… how do you say it? Relevant!! Finally I’ve found something that helped me. Cheers.

i like the role of Anthony Hopkins in the movie Silence of The Lambs. this guy is simply amazing.,

Many thanks for placing up this post, I feel every person will thanks for that.

Hey, have you ever before wondered to write regarding Nintendo or PS handheld?

That is a really good tip particularly to those new to the blogosphere. Brief but very accurate info… Appreciate your sharing this one. A must read post.

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

bookmarked!!, I like your web site!

dining room furnitures should be coated with shellac or varnish in order to preserve the wood grains.

Youre so cool! I dont suppose Ive read anything like this just before. So nice to get somebody with original ideas on this subject. realy thanks for starting this up. this amazing site is one thing that is needed on the internet, a person with a little originality. helpful project for bringing something totally new to your world wide web!

Have you ever heard of a decent design?? This one sucks man. The articles are great tho’.

Remarkably! It really is like you study my mind! A person seem to understand so considerably relating to this, exactly like you authored the book inside it or even some thing. I believe that you simply can do with a few pictures to drive the content residence a little, on top of that, this really is excellent weblog. A exceptional study. I’ll surely revisit again.

Excellent read, I just passed this onto a friend who was doing some research on that. And he actually bought me lunch since I found it for him smile So let me rephrase that: Thank you for lunch!

I discovered your site web site on bing and appearance a few of your early posts. Maintain inside the very good operate. I recently additional up your RSS feed to my MSN News Reader. Looking for forward to reading much more from you at a later date!…

Van Gogh painted a number of portraits of the postal worker in his official uniform, conveying his admiration for the man in the solidity of his kind and the quiet dignity of his expression.

Most I can state is, I’m not sure what to express! Except certainly, for the wonderful tips that happen to be shared within this blog. I will think of a million fun strategies to read the reports on this site. I believe I will eventually make a move making use of your tips on those things I could not have been able to deal with alone. You were so innovative to allow me to be one of those to profit from your helpful information. Please realize how great I am thankful.

It’s not that I want to duplicate your web site, but I really like the design and style. Could you let me know which design are you using? Or was it tailor made?

This is so great that I had to comment. I’m usually just a lurker, taking in knowledge and nodding my head in quiet approval at the good stuff…..this required written props. Theory rocks…thanks.

healthier hair is of course mainly due to genetics but food supplementation can also help you get it;

I’m keen on this post, enjoyed this one thank you posting .

Nicely I definitely loved learning it. This particular topic procured by a person is very efficient for accurate preparing.

Well We certainly loved studying this. This topic acquired using a person is quite effective for accurate planning.

i always look for those calcium fortified dog foods because they make my dog healther“

Awesome read , I’m going to spend more time researching this subject

bookmarked!!, I really like your website!

Karel Stokkermans (30 January 2000).

This was a great read! Your insights are truly helpful and make complex topics easy to understand. Looking forward to more!

Fantastic post! The information you shared is really valuable and well-explained. Thanks for putting this together!

The write-up has proven useful to me personally. It’s very useful and you’re obviously extremely well-informed in this region. You have got opened my own eyes to be able to varying thoughts about this particular topic along with intriguing and solid content material.

I like this website because so much utile material on here .

Good read , I’m going to spend more time learning about this subject

Good article! We are linking to this great content on our site. Keep up the good writing.

Although a referee helps, kids are often fairly anxious to point one another out.

As a result of it is the standard greeting here, ‘How are You?

That is the best blog for anyone who desires to search out out about this topic. You understand so much its nearly exhausting to argue with you (not that I truly would need aHa). You positively put a brand new spin on a subject thats been written about for years. Great stuff, simply great!

birthday invitations should be given as early as possible to avoid any surprises“

However, these different KPI metrics help you to potentially track the number of loyal customers coming on your website.

Youre so cool! I dont suppose Ive read anything like this before. So nice to discover somebody by original thoughts on this subject. realy appreciation for starting this up. this web site are some things that is required over the internet, a person with some originality. beneficial work for bringing interesting things to the web!

To paraphrase Bogle, no matter how the markets are doing, investment firms still make greater than half a trillion dollars per year.

Really enjoyed this article. It offered a lot of valuable insights. Fantastic job on writing this.

And the extra abilities you study, the more useful you may turn into in the marketplace.

If equipment must be assembled, learn and observe all producer’s instructions.

SecuX hardware wallets prote SecuX wallet cts your private key in a Secure Element chip, support

A hyper-efficient decentralized crypto marketplace built on Sui. Turbos finance Sui Trade Trade any crypto on Sui. Best prices are offered through aggregating liquidity.

Look at your efforts and also exactly what it’s always worth.

??? ?????? ????? ?? ?? ??????? ?? ???? ? ????? ????? ?????. ???? ???????? ????????? ??????????? ????? ????? ????? ?????.

There is clearly a bunch to identify about this. I feel you made various good points in features also.

Balances Active Orders Withdraw Deposit TradeOgre Logout · Sign In. Search: Currency, Market, Change, Price

BPI Net Empresas é o serviço do Banco BPI que permite gerir as contas e realizar operações bancárias online, com segurança e comodidade. Saiba mais sobre as vantagens, as operações Bpi Net Empresas

I am constantly looking online for articles that can facilitate me. Thx!

Hi buddy, your blog’s design is simple and clean and i like it. Your blog posts are superb. Please keep them coming. Greets!

*You made some decent points there. I looked on the internet for the issue and found most individuals will go along with with your website.

Empower Your Crypto Journey

with Tangem Wallet

Buy and sell Bitcoin, Ethereum, NoOnes and other cryptocurrencies Peer-to-Peer on NoOnes. Secure, fast, and user-friendly transactions on a trusted platform.

Balances Active Orders Withdraw Deposit TradeOgre Logout · Sign In. Search: Currency, Market, Change, Price

Bpi net empresas Portugal, bpi net empresas Serviços. Plataforma de comunicação Multibancária · Canal SWIFT Net · App BPI Empresas · BPI Net Empresas. Tudo Sobre. Open Banking · Segurança Online

Young youngsters could have a blast enjoying this sport!

After I initially commented I appear to have clicked the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I recieve four emails with the exact same comment. Is there an easy method you are able to remove me from that service? Cheers.

These payments can be obtained via a merchant fee processing system.

This was a great read! Your insights are truly helpful and make complex topics easy to understand. Looking forward to more!

I also conceive therefore , perfectly composed post! .

Aw, this is a really good post. In thought I have to put in place writing in this way moreover – spending time and actual effort to create a top notch article… but exactly what do I say… I procrastinate alot and by no means apparently get something done.

I am typically to blogging and i truly appreciate your posts. This article has really peaks my interest. I am about to bookmark your site and maintain checking achievable information.

Good web site you’ve got here.. It’s difficult to find high quality writing like yours nowadays. I honestly appreciate individuals like you! Take care!!

Very useful content! I found your tips practical and easy to apply. Thanks for sharing such valuable knowledge!

The smaller and lighter mud-like particles will drift much farther downwind, typically for a whole bunch of miles.

This post is very helpful! I appreciate the effort you put into making it clear and easy to understand. Thanks for sharing!

“I precisely needed to say thanks yet again. I am not sure what I could possibly have created in the absence of those tactics provided by you on this situation. Completely was the fearsome scenario in my view, but taking a look at a new expert tactic you resolved the issue forced me to jump for contentment. Now i am happier for the support and as well , pray you find out what a powerful job you are always accomplishing teaching men and women through your web page. I know that you haven’t got to know all of us.”

Great article! I learned a lot from your detailed explanation. Looking forward to more informative content like this!

Woh I enjoy your articles , saved to favorites ! .

Greetings! Very useful advice in this particular article! It is the little changes that make the biggest changes. Many thanks for sharing!

Howdy! This is my first comment here so I just wanted to give a quick shout out and tell you I genuinely enjoy reading your blog posts. Can you suggest any other blogs/websites/forums that go over the same subjects? Thanks!

Your style is really unique in comparison to other people I’ve read stuff from. Many thanks for posting when you have the opportunity, Guess I will just book mark this page.

I really enjoyed reading this! Your writing style is engaging, and the content is valuable. Excited to see more from you!

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

My brother suggested I might like this blog. He was entirely right. This post actually made my day. You cann’t imagine simply how much time I had spent for this info! Thanks!

Have you thought about incorporating some social bookmarking buttons to these blogs. At least for twitter.

I can’t really help but admire your blog, your blog is so adorable and nice “

22559207 Warrant Officer Class I Cecil Ivor Shoulders, Royal Military Ordnance Corps.

Excellent article. I discovered the details highly helpful. Adored the way you clarified everything.

This post is very helpful! I appreciate the effort you put into making it clear and easy to understand. Thanks for sharing!

Hey all, I had been just checkin out this site and that i really admire the inspiration want to know ,!

Great website you got here! Yoo man great reads, post some more! Im gon come back so better have updated

chefdro? The Stuff- Bryan Armen Graham: Crash Course: Manny Pacquiao vs

This post is fantastic! Filled with useful details and extremely articulate. Thanks for providing this.

In advance of you decide to create your own checklist to incorporate an idea associated with what camping checklist ought to. Really … A listing can be more than what you need.

Sustain superb piece of work, Someone said few web sites on this web site and i conceive that your particular internet site is rattling interesting and contains plenty of fantastic information.

I think youve made some actually helpful factors. Not as well lots of people would actually feel about this the best way you simply did. Im genuinely impressed that theres so much about this matter thats been uncovered and you also did it so nicely, with so considerably class. Fantastic one you, man! Definitely terrific things correct here.

Very useful content! I found your tips practical and easy to apply. Thanks for sharing such valuable knowledge!

An outstanding share! I have just forwarded this onto a colleague who had been conducting a little research on this. And he in fact ordered me lunch because I found it for him… lol. So allow me to reword this…. Thank YOU for the meal!! But yeah, thanx for spending time to discuss this matter here on your internet site.

Having read this I believed it was very enlightening. I appreciate you finding the time and energy to put this short article together. I once again find myself personally spending a significant amount of time both reading and leaving comments. But so what, it was still worth it.

Hey there! I just would like to offer you a big thumbs up for the great information you have got here on this post. I am coming back to your web site for more soon.

This post is very helpful! I appreciate the effort you put into making it clear and easy to understand. Thanks for sharing!

Aw, i thought this was a really nice post. In thought I would like to set up writing such as this additionally – taking time and actual effort to manufacture a great article… but exactly what can I say… I procrastinate alot and no indicates manage to go carried out.

Thank you a bunch for sharing this with all folks you really realize what you are talking approximately! Bookmarked. Kindly additionally discuss with my website =). We will have a hyperlink alternate arrangement among us!

I needed to create you the little bit of observation in order to thank you as before for these magnificent principles you have discussed above. This has been certainly pretty open-handed with people like you to allow freely precisely what many of us would’ve offered for sale as an ebook in order to make some profit on their own, certainly seeing that you might well have tried it if you wanted. Those principles likewise acted to be a great way to fully grasp most people have a similar fervor like my very own to know somewhat more in terms of this problem. I am sure there are a lot more enjoyable times up front for individuals who read carefully your blog.

The HSB is much less a hybrid bicycle than a hybrid motorbike, in response to Bubilek, supposed for trips properly past a number of miles from residence.

Can I just say what a relief to find someone that really knows what they’re discussing on the internet. You actually realize how to bring a problem to light and make it important. A lot more people should look at this and understand this side of the story. I was surprised you’re not more popular since you certainly have the gift.

Really enjoyed going through this entry. It’s highly clear and filled with valuable details. Many thanks for offering this.

Marveling at the sapphire depths of the Mediterranean Sea offers endless adventures. From swimming in sunlit olive groves, every memory here is paradise on earth.

I really enjoyed reading this! Your writing style is engaging, and the content is valuable. Excited to see more from you!

Fault, vice; wickedness, damage, hurt.

It’s hard to come by knowledgeable people in this particular topic, however, you sound like you know what you’re talking about! Thanks

Excellent article. It offered plenty of useful details. I am grateful for the work you put in to compose this post.

This article is extremely educational. I genuinely appreciated going through it. The content is highly structured and straightforward to comprehend.

I like reading through a post that will make men and women think. Also, thank you for allowing me to comment.

Well-written and insightful! Your points are spot on, and I found the information very useful. Keep up the great work!

Loved this article. It’s highly detailed and packed with helpful insights. Excellent work!

If you are still questioning, just how much to install air conditioning,

worry no more.

If you are billed per hour, then period is very appropriate to the

expense.

For restricted buildings, we can install ducted air conditioning

without outside system.

Gym cooling systems supply a more secure and extra comfy workout setting.

Anticipate to spend in between ₤ 500 and ₤ 1500 for a split

a/c that will be utilized in one area.

A/c systems can only be installed by certified air conditioning

designers.

We offer a complete style and setup solution for all types of Samsung cooling systems.

Our 10-year warranty will ensure that you get the long life and ideal value for cash

feasible.

bed frames that are based on steel would give you a more durable bed and a bed that last longer,,

Jason Derulo is still at the top of the Uk singles chart for the second week with his latest track Don’t Wanna Go Home. The Us artist is without question fending off tight opposition

It’s not that I want to duplicate your web site, but I really like the design and style. Could you let me know which design are you using? Or was it tailor made?

Both indoor devices serve a solitary area and they are both either on or off.

Acquired air-con a couple of weeks ago for my home office, installation within a week which was

clean and tidy, it looks fantastic.

It makes it much easier for the electrical contractor when they come to help you out.

This portable air cooler would certainly suffice for cooling down a

garage, sunroom, cooking area, or tiny studio apartment.

Wall placed a/c units are one of the most common kind of cooling.

We have a wide selection of a/c for you to select from depending on your demands.

you have got a great blog here! do you want to cook some invite posts in this little weblog?

I just wanted to type a simple note to thank you for those wonderful pointers you are writing at this website. My considerable internet investigation has finally been honored with really good insight to share with my companions. I would mention that we readers actually are quite fortunate to exist in a fantastic network with very many lovely individuals with valuable solutions. I feel somewhat privileged to have encountered your web site and look forward to so many more thrilling times reading here. Thanks a lot once again for all the details.

Your blog is certainly wonderful, don’t stop the nice work!

Installing cooling in a workplace of your home can aid enhance performance.

We provide a totally free site check out after we have actually sent you a cost-free quote by email.

We’re based in London, enabling us to be

more adaptable with our appointment times.

If you are billed per hour, after that period is very

relevant to the price.

The very next time I read a blog, I hope that it does not disappoint me as much as this particular one. After all, Yes, it was my choice to read, nonetheless I truly believed you would probably have something interesting to say. All I hear is a bunch of whining about something that you can fix if you weren’t too busy seeking attention.

I really like looking through an article that will make people think. Also, many thanks for allowing me to comment.

Dead pent subject matter, thanks for entropy.

You ought to actually take into consideration engaged on developing this blog into a serious authority on this market. You evidently have a grasp deal with of the subjects everyone seems to be searching for on this website in any case and you may certainly even earn a buck or two off of some advertisements. I’d discover following recent matters and raising the amount of write ups you place up and I assure you’d start seeing some wonderful targeted site visitors within the close to future. Just a thought, good luck in no matter you do!

Tremendous review! Would like had this analyzing. I’m hoping to find out a lot more of you. I know you may have beneficial details combined with prospect. I’m just seriously contented from this information and facts.

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

Arg! Youd think I would have noticed that! Thanks for pointing it out, its been corrected.

But trust me, this movie is actually original in its plot structure as there were plot twists I didn’t see coming.

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

I think you’re absolutely right. I found a similar viewpoint on https://vb77.wiki/, and their analysis gave me a lot to think about.

오피사이트 made it so easy to check out different massage shops in my area.

I think this is a very valid point. I read a similar article on vb77.wiki that provides more context on this, and it helped me think about it from a different angle.

I always find the best webtoons on 블랙툰.

O BCE é o banco central dos ibercaja empresas países da UE que utilizam o euro. O nosso principal objetivo é a manutenção da estabilidade de preços. Para o efeito

I found a luxury spa for a Swedish massage through 오피가이드.

Thanks to 오피뷰, I’ve found the best massage therapists in the area.

I discovered some amazing webtoons on 블랙툰, definitely worth visiting.

I’m always up-to-date with the newest releases on 블랙툰.

The user reviews on 펀초이스 are so helpful when choosing a massage parlor.

So an enlightening entry! I picked up tons from going through it. Your information is very well-organized and easy to follow.

Hello! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good

results. If you know of any please share. Appreciate it!

You can read similar blog here: Code of destiny

An interesting discussion is value comment. I think that you need to write extra on this subject, it might not be a taboo subject however generally individuals are not sufficient to talk on such topics. To the next. Cheers

One thing I would really like to discuss is that weightloss program fast can be achieved by the appropriate diet and exercise. Ones size not simply affects the look, but also the overall quality of life. Self-esteem, depressive disorder, health risks, along with physical skills are damaged in excess weight. It is possible to make everything right whilst still having a gain. In such a circumstance, a medical problem may be the culprit. While an excessive amount of food and never enough exercising are usually responsible, common health conditions and traditionally used prescriptions can greatly help to increase size. Many thanks for your post here.

i always want a dining room that is brightly colored that is why i always paint our room with cream accent`

This is a great point! I remember reading an article on https://388bet.now that touched on this exact issue, and it provided some really insightful information that supports your argument.

I completely agree with this viewpoint, it’s very well thought out. I recently read an article that explores similar ideas on bossfun.zone, and I think it adds more depth to the discussion.

you possess a excellent weblog here! want to have invite posts on my weblog?

As I website possessor I believe the content matter here is rattling fantastic , appreciate it for your efforts. You should keep it up forever! Best of luck.

i would always be a fan of Nip/Tuck, i was saddened about the episode when one of the doctors got breast cancer”

Bem embalado. Surpreendeu pela qualidade.

Recomendo a todos. Chegou conforme descrito.

i use Garmin GPS whenever i go out, Garmin GPS is very reliable*

This is the correct weblog for everyone who has to search for away relating to this topic. You observe a great deal its practically time consuming to be able to claim with you (not that I actually would want?HaHa). An individual favorably put a whole new spin on a subject thats been discussed for a long time. Great things, merely fantastic!

I recently found and came across your blog and have reading , i will keep reading this blog everyday.

I was just chatting with my coworker about this last week at the resturant. Don’t know how in the world we landed on the subject really, they

I’m really loving the appearance/layout of this weblog – Gulvafslibning | Kurt Gulvmand , Will you actually face any browser interface problems… A number of our own visitors sometimes unhappy with my site not operating effectively in Internet Explorer but looks good inside Opera. Do you possess any advice to aid resolve this problem BTW how about Bahrain incredible news flash

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

When I originally commented I clicked the -Notify me when new feedback are added- checkbox and now every time a remark is added I get four emails with the same comment. Is there any approach you’ll be able to remove me from that service? Thanks!

It arduous to seek out knowledgeable people on this topic, however you sound like you recognize what you are talking about! Thanks

Fantastic wordpress weblog right here.. It is challenging to locate top quality writing like yours these days. I really value men and women like you! get treatment

I’m amazed, I must say. Rarely do I encounter a blog that’s equally educative and engaging, and without a doubt, you’ve hit the nail on the head. The problem is something which not enough folks are speaking intelligently about. I am very happy I found this in my hunt for something relating to this.

I was able to find good advice from your blog posts.

Thank you for each of your efforts on this web page.

An impressive share, I simply with all this onto a colleague who had previously been carrying out a little analysis during this. And then he in reality bought me breakfast since I came across it for him.. smile. So permit me to reword that: Thnx for the treat! But yeah Thnkx for spending any time to go over this, I feel strongly about this and enjoy reading read more about this topic. Whenever possible, as you grow expertise, would you mind updating your website with more details? It is extremely helpful for me. Massive thumb up for this short article!

Hello! I want to provide a large thumbs up for the wonderful information you have here within this post. I will be coming back to your blog post for much more soon.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

On a positive note there were some funny lines in the screenplay, most of them were from Marvin Boggs.

Great – I should definitely say I’m impressed with your site. I had no trouble navigating through all the tabs as well as related info. The site ended up being truly easy to access. Excellent job.

Simply wanna state that this is very useful , Thanks for taking your time to write this.

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

Hey! Delighted by the theme—it’s charming. In fact, this post brings a incredible touch to the overall vibe. Great effort!

I really like your blogposts on here but your Rss has a handful of XML errors that you need to fix. Excellent post nevertheless!

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

I’d have got to check with you here. Which is not some thing I usually do! I quite like reading a post that may get people to believe. Also, thanks for permitting me to comment!

This article is incredibly informative. I genuinely appreciated reading it. The information is very well-organized and straightforward to comprehend.

O BPI é o banco central dos países da PT que utilizam o euro. O nosso principal objetivo é a manutenção da estabilidade de preços. Para o efeito

bpi net empresas

Hi there! I could have sworn I’ve been to this website before but after going through some of the articles I realized it’s new to me. Anyways, I’m definitely delighted I stumbled upon it and I’ll be bookmarking it and checking back frequently.

I’m glad that I observed this internet weblog , just the right information that I was looking for! .

I discovered your blog internet site on bing and appearance several of your early posts. Preserve up the very good operate. I just now additional the RSS feed to my MSN News Reader. Seeking toward reading far more on your part down the road!…

Hello. Very cool web site!! Man .. Beautiful .. Superb .. I’ll bookmark your web site and take the feeds also…I’m satisfied to locate a lot of useful information here in the article. Thanks for sharing..

Dentistry Search Engine Optimization, commonly called Dentist SEO, is a specific methodology implemented to increase the digital footprint of dental practice online platforms. This systematic process utilizes multiple tactics for outstanding dental content, including keyword optimization, site optimization, material writing, and link building, explicitly designed to draw possible patients looking for dental care on popular search engines such as Google or Bing. Check out more information about this.

This is a correct blog for anybody who really wants to be made aware of this topic. You understand so much its practically challenging to argue along (not too I actually would want…HaHa). You certainly put the latest spin with a topic thats been discussed for decades. Great stuff, just wonderful!

Appreciate it for helping out, fantastic information.

Hi. Nice, interesting post, along with a little as they are. I learned new things today!

Looking for the ultimate slots online experience? Explore Okeplay777, the leading destination for slot enthusiasts. With various thrilling games and huge rewards, this trusted casino delivers an superior entertainment value. Whether you’re a novice or professional player, Okeplay777 accommodates all skill levels. Find out more tips about maximizing your success rate today!

After looking at a few of the articles on your web site, I seriously like your way of writing a blog. I bookmarked it to my bookmark site list and will be checking back soon. Please check out my web site as well and tell me how you feel.

So an informative article! I learned a lot from going through it. Your content is highly structured and straightforward to comprehend.

I like it when folks get together and share thoughts. Great website, keep it up!

for yet another great informative article, I’m a loyal reader to this blog and I can’t say how much valuable information I’ve learned from reading your content. I really appreciate all the hard work you put into this great blog.

Hello, have you by chance pondered to create regarding Nintendo Dsi handheld?

It’s really a cool and useful piece of information. I’m satisfied that you shared this useful information with us. Please stay us informed like this. Thank you for sharing.

You made some good points there. I did a search on the topic and found most people will agree..

Hey there! Nice post! Please inform us when we will see a follow up!

dog grooming is the specialty of my sister, she really loves grooming every dog in our house**

The fastened signs, Taurus, Leo, Scorpio, and Aquarius, share widespread traits that may create a strong foundation for lengthy-lasting relationships.

Nice post. I learn something harder on distinct blogs everyday. Most commonly it is stimulating to learn content from other writers and exercise a specific thing from their store. I’d choose to use some while using content in my weblog whether you don’t mind. Natually I’ll supply you with a link in your internet blog. Thank you for sharing.

In my opinion, when the ratio concerning daily life being a lever, values is its own “point”, while using proper rocker, it might become a amazing someone.

I am usually to blogging and i genuinely appreciate your posts. This content has really peaks my interest. I’m going to bookmark your site and maintain checking for first time info.

Westbrook, Jesse (5 September 2013).

Hello! I could have sworn I’ve been to this web site before but after going through many of the articles I realized it’s new to me. Regardless, I’m certainly delighted I discovered it and I’ll be book-marking it and checking back frequently.

Put apart all prejudices and, summoning your spiritual forces, aid mankind.

Loved the information in this entry. It’s highly comprehensive and full of helpful information. Fantastic job!

3. To be able to fill your empty stomach; you will need to attempt the basic contemporary fish and chips at the most popular Kelly鈥檚.

Having read this I believed it was rather enlightening. I appreciate you taking the time and energy to put this short article together. I once again find myself personally spending a significant amount of time both reading and posting comments. But so what, it was still worth it!

David Owen, QPM, Chief Constable, North Wales Police.

Having read this I thought it was extremely enlightening. I appreciate you finding the time and energy to put this informative article together. I once again find myself personally spending way too much time both reading and posting comments. But so what, it was still worth it.

You really should be a part of a contest for just one of the greatest blogs on the net. I am going to suggest this great site!

I think this web site has very superb composed subject material articles .

I had been wondering should anyone ever considered changing layout , design of the blog? Its very well written. I enjoy what youve have got to say. But you could a tad bit more when it comes to content so people could connect with it better. Youve got a lot of text for only having a couple of images. You may could space it out better?

Absolutely agree with you! I’ve also seen similar points discussed on https://win79game.asia//, and it’s clear that the topic is receiving increasing attention and thoughtful analysis.

Why don’t you embody the experiences you’ve had with a client and the ease with which you helped them discover a restfully lovely house, in your blog?

Buy and sell Bitcoin, Ethereum, tangem wallet and other cryptocurrencies Peer-to-Peer on NoOnes. Secure, fast, and user-friendly transactions on a trusted platform.

O BPI é o banco central dos países da PT que utilizam o euro. O nosso principal objetivo é a manutenção da estabilidade de preços. Para o efeito

bpi net empresas

Hi everyone! I’m impressed by this piece—it’s great. In fact, the concept brings a great touch to the overall vibe. Cheers!

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to more added agreeable from you! However, how can we communicate?

It arduous to search out educated people on this topic, but you sound like you realize what you are talking about! Thanks

I am incessantly thought about this, thanks for putting up.

This is a great point! I remember reading an article on ho88 that touched on this exact issue, and it provided some really insightful information that supports your argument.

That is just as true for different apparently “single-nation” mergers, such as the $29-billion merger of Swiss drug makers Sandoz and Ciba-Geigy (now Novartis).

Good info. Lucky me I recently found your blog by accident (stumbleupon). I have saved it for later.

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

Hello there! This post could not be written any better! Looking at this article reminds me of my previous roommate! He always kept preaching about this. I am going to send this article to him. Pretty sure he’ll have a great read. I appreciate you for sharing!

Freezing realized your blog site a week ago so i are usually following the software daily. There is a loads of tips right so i relish look for this online site far too. Stick to the good quality deliver the results!

Pretty! This was an extremely wonderful post. Thank you for providing this info.

Thank you for the sensible critique. Me & my neighbor were just preparing to do a little research about this. We got a book from our area library but I think I learned more from this post. I am very glad to see such fantastic information being shared freely out there.

This post is highly enlightening. I really enjoyed reading it. The content is extremely arranged and simple to comprehend.

O BPI é o banco central dos países da PT que utilizam o euro. O nosso principal objetivo é a manutenção da estabilidade de preços. Para o efeito

bpi net empresas

Great article! We will be linking to this particularly great article on our site. Keep up the great writing.

Chew continued to participate within the conferences of the Tammany Society, to honor Tamanend, the Lenni-Lenape chief who first negotiated peace agreements with William Penn.

There is noticeably a bundle to know about this. I assume you made particular nice points in features also.

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

Give Me Free Money.

A yr later, McGee confirmed up on another standard present: “Grey’s Anatomy.” For two episodes of Season 14, McGee performed Liz Brosniak, a pregnant lady who checks herself into the hospital for again pain (which is revealed to be early contractions, as she is only at 23 weeks).

I wanted to produce you this tiny remark so as to give numerous thanks when once again contemplating the spectacular suggestions you’ve discussed at this time. It was very strangely open-handed of you to supply unhampered specifically what a whole lot of folks could possibly have marketed for an electronic book in creating some money for themselves, most importantly because you may well have tried it in the event you decided. Those fundamentals furthermore served to present a great method to totally grasp some folks have the very same keenness considerably like my very own to see a whole lot a lot more on the subject of this condition. I think you will find many far more enjoyable opportunities ahead for individuals who looked over your site.

When I originally left a comment I appear to have clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I recieve 4 emails with the exact same comment. Is there an easy method you can remove me from that service? Many thanks.

I love reading through a post that will make people think. Also, many thanks for permitting me to comment.

Upon exploring multiple organization systems, I discovered this in-depth examination about steel lockers. These premium storage facilities have shown to be exceptionally beneficial for maintaining private possessions in assorted business environments. The exceptional robustness of these industrial-grade storage solutions makes them an superior selection for permanent preservation needs.

Most bladesmiths want the flexibleness that forging offers them with when creating customized swords.

FINRA Rulebook Notification permits you to remain notified of the modifications to the content within the FINRA Rulebook dataset .

Đừng đầu tư hoặc chuyển tiền qua vinacomintower.com!

Simply killing some in between class time on Digg and I found your article . Not usually what I choose to read about, but it was completely price my time. Thanks.

Nice post. I learn something totally new and challenging on websites I stumbleupon everyday. It’s always interesting to read articles from other authors and practice something from their sites.

I think you’ve captured the essence of this issue perfectly. I recently came across an article on https://zomclub.black that offers a similar viewpoint, and it made me think about this topic from a different angle.

I’d like to thank you for the efforts you’ve put in penning this blog. I really hope to check out the same high-grade blog posts from you in the future as well. In truth, your creative writing abilities has inspired me to get my own site now 😉

I completely agree with your perspective here. I came across a very similar viewpoint on Hdbet, which provided additional context to deepen my understanding of the issue.

Everything is very open with a really clear description of the issues. It was definitely informative. Your website is very helpful. Thanks for sharing.

There are a couple of intriguing points soon enough in this article but I do not know if them all center to heart. There is certainly some validity but I am going to take hold opinion until I explore it further. Great write-up , thanks so we want a lot more! Combined with FeedBurner too

An intriguing discussion is definitely worth comment. I think that you need to publish more on this subject matter, it may not be a taboo subject but generally people don’t talk about such subjects. To the next! Cheers.

Having read this I believed it was very informative. I appreciate you taking the time and effort to put this content together. I once again find myself personally spending a lot of time both reading and posting comments. But so what, it was still worth it.

I love your blog.. very nice colors & theme. Did you

design this website yourself or did you hire someone to do it

for you? Plz reply as I’m looking to create my own blog and would like

to know where u got this from. thanks a lot https://Menbehealth.Wordpress.com/

I am extremely impressed together with your writing talents and also with the layout on your blog. Is that this a paid subject or did you customize it your self? Either way keep up the excellent high quality writing, it is uncommon to look a great weblog like this one nowadays. I like chargebacksecurity.com ! It’s my: Stan Store

mexicoexpo2020.com có thể chứa mã độc, không truy cập!

Audio began playing when I opened up this internet site, so irritating!

I am really inspired together with your writing abilities and also with the layout to your weblog. Is that this a paid subject matter or did you customize it your self? Either way keep up the nice quality writing, it’s rare to look a great weblog like this one nowadays. I like chargebacksecurity.com ! It’s my: Instagram Auto comment

It’s difficult to find experienced people on this subject, however, you seem like you know what you’re talking about! Thanks

I agree with this completely. I’ve seen a very similar opinion discussed on https://v8club.deal, and it helped me understand the topic in much greater detail.

Excellent information about IT Support Outsourcing and Services. Information Technology Services Transfer can trim budgets while improving efficiency. For more great insights, check out this link

This is a topic which is near to my heart… Cheers! Exactly where are your contact details though?

Several labor unions supplied support to these strikes together with the AFL-CIO, Target Staff Unite, UFCW, and the IWW.

I agree with your view entirely. I’ve seen a similar opinion shared on https://debets.cc, and the article there adds great depth to this topic.

Pretty part of content. I just stumbled upon your weblog and in accession capital to assert that I get actually loved account your weblog posts. Any way I’ll be subscribing on your feeds or even I success you access constantly fast.

Yes, this resonates with me completely. I recently read an article on ho88.one that covers the same subject, and it provided some great insights that complement your argument.

Survived by one son, Berdell Hose, Portland, OR; one daughter, Mrs Hazel Novotney, Wilbur, WA; Four grandchildren; 9 nice grandchildren.

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

Excellent material about Sprained Ankle Physio in Singapore. Joint Recovery Program can increase flexibility while ensuring proper healing.

Good job!

Brilliant article about Sprained Ankle Physio in Singapore. Professional care is significant in overcoming ankle injuries. Pertaining to ankle injuries, specialized therapy is essential for successful treatment.

Firstly one should consider the sovereign threat high quality of the nation after which consider the firm’s credit quality.

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

Due to the excessive salt content and other factors, the one residing organisms within the Pink Lake are microorganisms including Dunaliella salina – a purple algae which trigger the salt content within the lake and creates a pink dye that offers the lake its color – in addition to red Halobacteria, which is present in the salt crusts.

You’ve made some good points there. I checked on the net to find out more about the issue and found most people will go along with your views on this site.

Espresso. I can handle the heat!

Well explained, thanks!

I have to thank you for the efforts you have put in writing this site. I’m hoping to see the same high-grade content from you later on as well. In fact, your creative writing abilities has motivated me to get my own, personal blog now 😉

After going over a number of the articles on your web page, I really like your technique of writing a blog. I book-marked it to my bookmark webpage list and will be checking back soon. Take a look at my website too and let me know your opinion.

A baby has it’s individual set of needs and so, parents must take this into serious consideration and thus raise the baby in a better and standard way.

May I simply just say what a comfort to uncover someone who truly knows what they are talking about online. You definitely understand how to bring a problem to light and make it important. More people have to read this and understand this side of the story. I was surprised that you are not more popular because you certainly have the gift.

Loved the tips here!

Great info. Lucky me I discovered your website by accident (stumbleupon). I’ve saved it for later!

Hello there, You have done a great job. I’ll definitely

digg it and personally recommend to my friends. I’m confident they will be benefited from this

web site.

Fantastic breakdown.

Your posts never disappoint.

I am in fact thankful to the holder of this site who has shared this wonderful

article at at this place.

Wow, fantastic blog layout! How long have you been blogging for?

you make blogging look easy. The overall look of your web site is wonderful, as well as the content!

I was recommended this web site via my cousin. I

am now not positive whether or not this put up is

written via him as nobody else understand such

exact about my difficulty. You’re incredible!

Thank you!

Hi colleagues, good post and good arguments commented at this place, I am truly enjoying by these.

Really no matter if someone doesn’t know then its up to other people that they will help,

so here it occurs.

We absolutely love your blog and find the majority of your post’s to be just

what I’m looking for. Do you offer guest writers